Newly untethered remote workers and business owners are taking advantage of the ability to work anywhere—moving to locations that better align with personal financial goals and lifestyles. California ranked second in outbound-migration volume in 2020 as people weighed the cost of living, tax rates, and quality of life with alternatives, according to CNN.

If you’re considering a residency transition for financial reasons, there are many options available. These range from a complete out-of-state move to transferring assets to a non-California trust.

Based on your needs, these changes can be complex—especially if they accompany an anticipated liquidity event, such as a business transfer. This makes estate planning, financial planning, and state income-tax planning critical to your overall success.

It also means you can benefit from carefully and thoughtfully analyzing your goals and putting the right advisors in place to help you achieve them.

Below, gain insight into several different residency transition options and alternatives, including pros, cons, and implications of each.

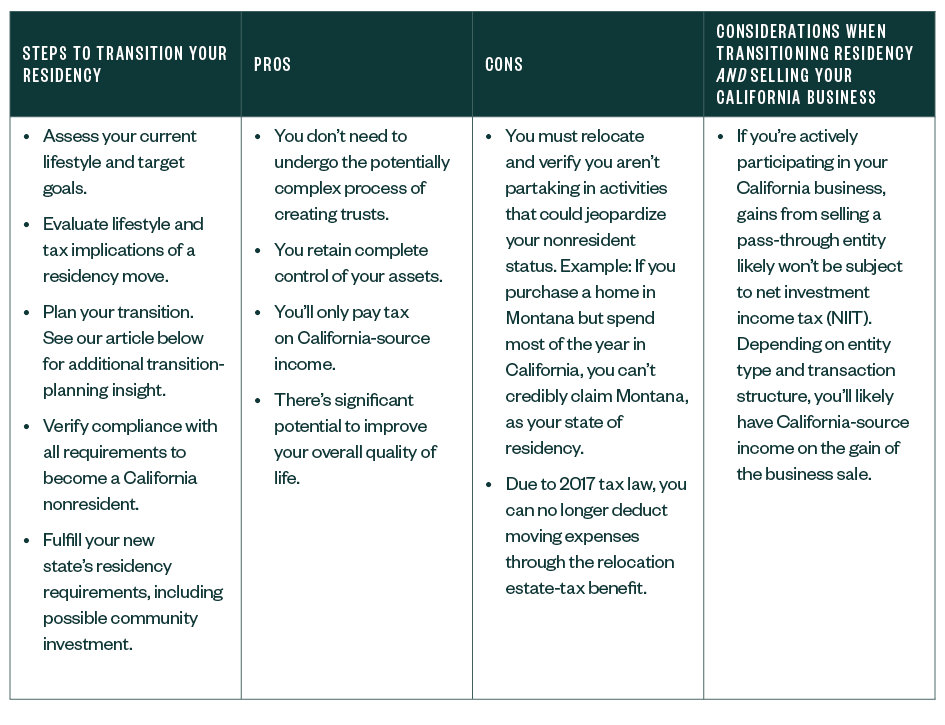

Transfer Your Residency from California

Perhaps the most straightforward option to align your financial goals and lifestyle is to change your primary residency by moving out of California.

When considering this option, it’s important to note the importance of intent. While individuals can have many homes in many states, a residency transition is a shift in your true, fixed, and primary residence.

To avoid any complications, it’s key to fully understand the unique state requirements for establishing your new residency.

For more information on how to plan your transition, read our article: Out-of-State Residency Transitions: Tax Planning for Individuals and Trusts.

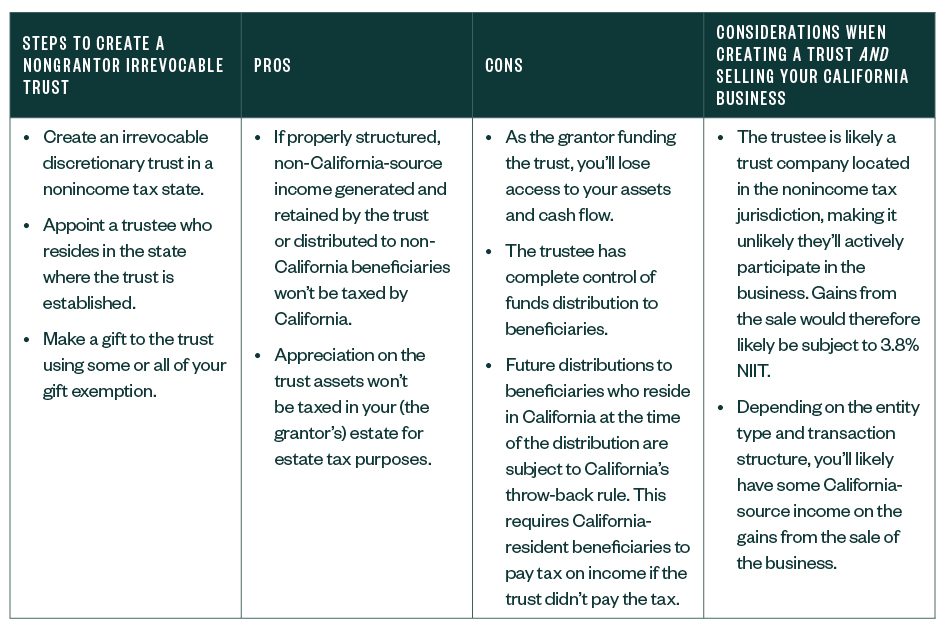

Nongrantor Irrevocable Trusts

If your primary concern is establishing a benefit for children and future heirs, a nongrantor irrevocable trust is another option to consider. Here are some basic roles to understand before creating a trust:

- Grantor. A person who creates a trust and places the assets into it.

- Trustee. A person or company that holds and administers a trust’s assets for the benefit of another.

- Beneficiary. A person who receives a distribution, known as a benefit, from a trust.

Creating a nongrantor trust in another state means your children and future heirs can benefit from non-California income generated by the trust. This also means you’re able to continue residing in California.

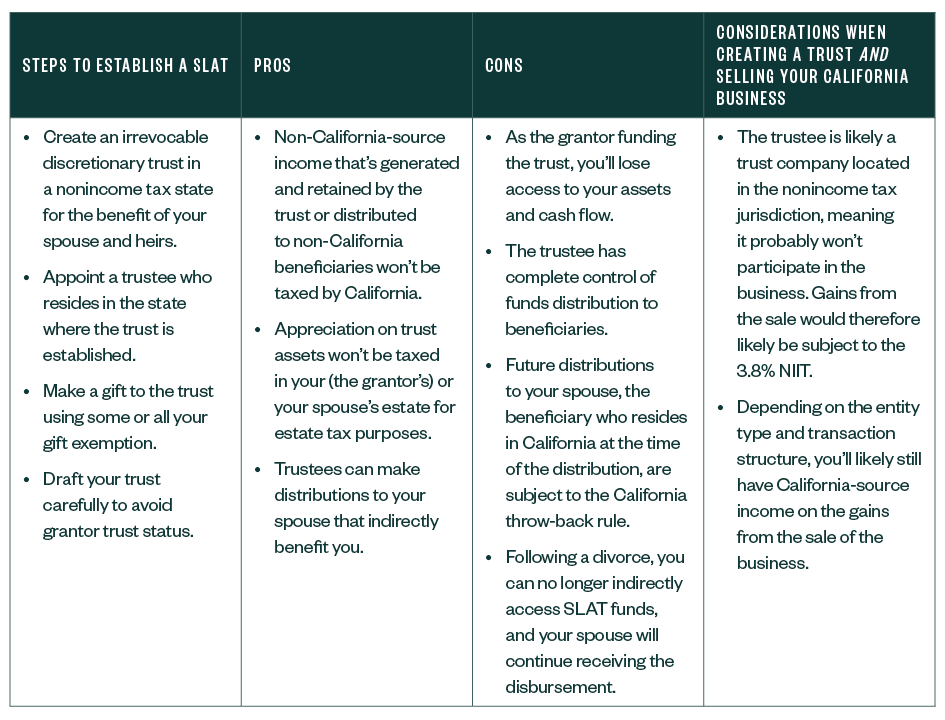

Nongrantor Spousal Lifetime Access Trust

At its most basic, a nongrantor spousal lifetime access trust (SLAT) is a gift from one spouse in a trust to the other spouse.

Unlike other spousal trusts, SLATs are funded by a gift while both spouses are alive. The beneficiary spouse can receive distributions from the SLAT, yet the SLAT’s designed to be excluded from the beneficiary spouse’s gross estate.

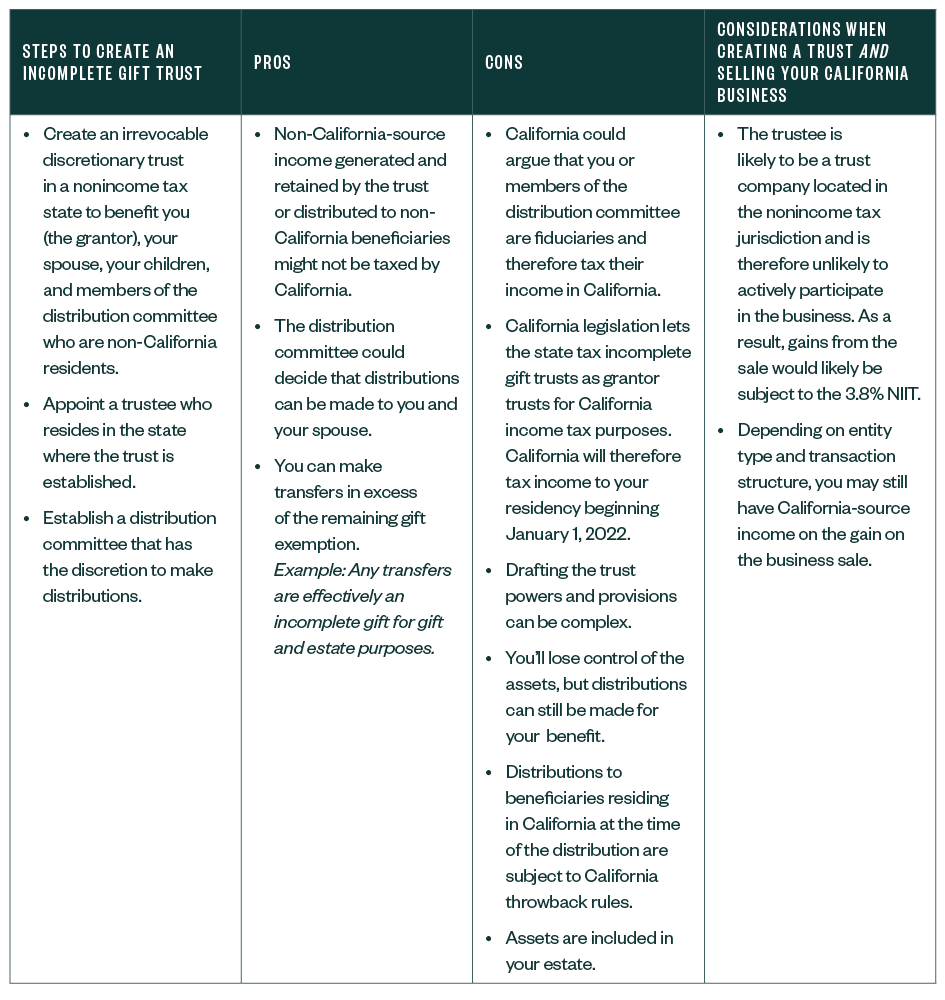

Nongrantor Incomplete Gift Trust

The final option doesn’t require a move and involves creating a trust for the benefit of grantor, spouse, children, and members of the distribution committee in a nonincome tax state.

Next Steps

While this insight focuses on California, an experienced professional can assist in residency transitions for any state. Residency transitions should occur well in advance of any large income event to properly execute the plan and manage the details.

Because this type of planning is complex and comes with some level of risk, it’s important to start early and engage competent advisors. Exploring where you want to move and why is an important first step.

Learn more about key considerations for changing residency in our article, Out-of-State Residency Transitions: Tax Planning for Individuals and Trusts.

We’re Here to Help

To learn more about long-term implications of a residency change, including the holistic tax and wealth management impacts, explore our articles for individuals, families, and businesses.

Reach out to your Moss Adams professional to discuss your options and available strategies to undergo a residency transition successfully.